24+ co-borrower on mortgage

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Free 6 Mortgage Quote Request Samples In Pdf

Compare Home Financing Options Get Quotes.

. Indeed The Wall Street. Web Co-borrowers are becoming more popular. Co-signers on the other hand generally dont stand to benefit from the loan.

Web Roommates can take out a reverse mortgage together as co-borrowers as long as they meet the eligibility requirements. The procedures and difficulty of removing a co-borrower or a cosigner from a mortgage are largely the same but the terms are not synonymous. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Ad Compare Loans Calculate Payments - All Online. Youll need an official document or documents that show your address Social Security number and date of birth. Comparisons Trusted by 55000000.

Co-borrowers on a mortgage are mainly used when the primary applicant has good. Theyre often called a co-applicant. Web A co-borrower is a person who applies for and shares liability of a loan with another borrower.

Best Mortgage Lenders in New York. To qualify as a cosigner. Web Peter Beeda The Mortgage Expert July 24 2022 - 16 min read.

Web Essentially if you co-sign a mortgage loan youll be evaluated as if you were a co-buyer of the home. Under these circumstances both borrowers are responsible for. Ad 5 Best House Loan Lenders Compared Reviewed.

Web A co-borrowers name is seen on both the title and the loan meaning they have a right to the property and share the responsibility of loan payback with the primary borrower on. Web Theres no legal limit to the number of co-borrowers on a mortgage but lenders rarely take applications from more than four or five borrowers due to limits on underwriting software. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

But co-borrowing takes the commitment one step further and can offer more. Web Co-borrower vs Co-signer. Save Real Money Today.

Instead the purpose of a co-signer is to help the primary. Web Published on January 24 2022. Web But as basic information here are three of the most common ways you could make the transition from co-borrower to the sole mortgage payer and homeowner.

Co-borrower mortgages have seen an explosion in popularity over the last seven years. Keep in mind however that you wont have the same. Apply Get Pre-Qualified in 3 Minutes.

Web As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. HUD Non-Occupant Co-Borrowers Mortgage Guidelines allow non-occupant co-borrowers to be. Any additional borrowers whose names appear on loan documents and whose income and credit history are used to qualify for the loan.

Web Co-borrowing and co-signing can make qualifying for a loan at the best rates easier. For instance for home equity conversion.

Should You Consider Adding Co Borrower To Your Mortgage

How Getting A Mortgage With A Co Borrower Affects The Deed Deeds Com

6 Mortgage Contract Templates Free Sample Example Format Download

Free 6 Mortgage Quote Request Samples In Pdf

Delegated Underwriting Training Ppt Download

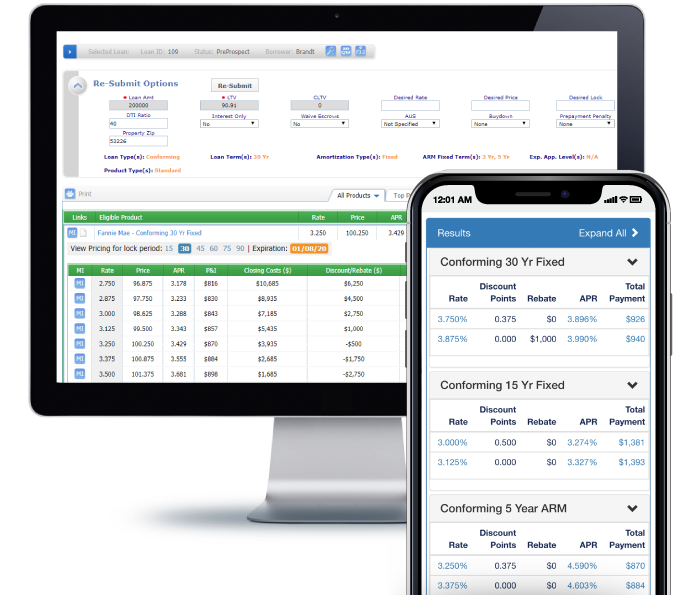

Product Pricing Engine Mortgage Ppe For Lenders Optimal Blue

Should You Add A Co Borrower To Your Mortgage Bankrate

Should You Add A Co Borrower To Your Mortgage Bankrate

17 Best Personal Loan Lenders Loans In As Little As 24 Hrs

Oaktree Funding Non Prime Select Guidelines

Delegated Underwriting Training Ppt Download

Joint Home Loan Eligibility Rules Income Tax Benefits

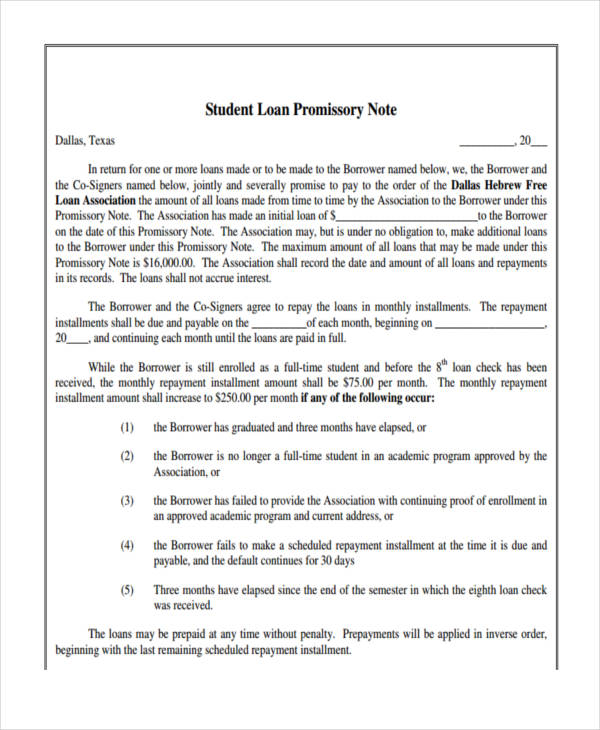

Loan Note 6 Examples Format Pdf Examples

Bad Credit Loans Beta Home Loans

Student Loan Default Could Cross Pre Covid Levels Without Debt Relief Nasdaq Sofi Seeking Alpha

Arian Eghbali

Loan Note 6 Examples Format Pdf Examples